are st jude raffle tickets tax deductible

For the purpose of determining your personal federal income tax the cost of a raffle ticket is not deductible as a charitable contribution. These changes will become apparent in the taxes you file your tax return.

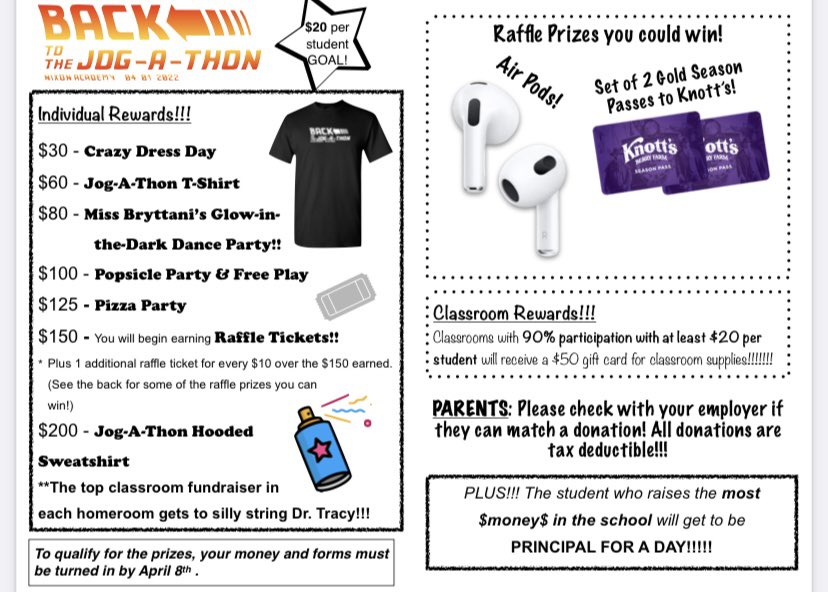

Nixon Academy Nixonacademy Twitter

Income phaseouts have also been increased until 2025.

. This is because the purchase of raffle tickets is not a donation ie. The drawing will be held on June 20 2009. If you donate property to be used as the raffle prize itself its value may be deductible as a charitable contribution.

This is because the purchase of raffle tickets is not a donation i. There is the chance of winning a prize. Jude Childrens Research Hospital.

Are raffle tickets tax-deductible. All of the proceeds go directly to St. The IRS does not allow raffle tickets to be a tax-deductible contribution.

Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return. Josephs altars are traditionally built. For specific guidance see this article from the Australian Taxation Office.

Jude Childrens Research Hospital is exempt from federal income taxes under Section 501C 3 of the Internal Revenue Code. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. The IRS does not allow raffle tickets to be a tax-deductible contribution.

Your modified adjusted gross income where the phaseout begins is 200000 for single. The house is divided into two separate volumes. Jude Dream Home.

Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. Are dream house raffle tickets tax-deductible. Jude Dream Home raffle ticket purchases to be made online by any person outside the scope of the applicable statutes regulations and the attached terms and conditions.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Is St Judes tax deductible. Jude Dream Home Giveaway house.

However the answer to why raffle tickets are not tax-deductible is quite simple. This might sound nonsensical on the surface. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Although raffles tickets are a form of donation they are not tax deductible. The Tax Cuts and Jobs Act TCJA increased the credit up to 2000 until 2025 to offset the removal of many personal exemptions. Jude and its mission.

Jude does not currently allow St. Both public and private St. Therefore your gift is tax-deductible to the full extent provided by law.

Jude Birthday Fundraiser Instead of Gifts. This might sound nonsensical on the surface. The IRS has adopted the position that the 100 ticket price is not deductible as a charitable donation for Federal income tax purposes.

Are raffle tickets tax-deductible. The IRS does not allow raffle tickets to be a tax-deductible contribution. You will have a chance to.

It may be deductible as a gambling loss but only up to the amount of any gambling winnings from that tax year. The IRS does not allow raffle tickets to be a tax-deductible contribution. The purchase of a raffle ticket is not considered a charitable donation.

All raffles with anticipated net proceeds of over 5000 for a single raffle and over 30000 for cumulative raffles within a calendar year still require either a verified statement of raffle operations prior to the conduct of a raffle GCVS1 for net proceeds of over 5000 for a single raffle or a license. New York State Gaming Commission. Winner must be present.

Raffle tickets can be sold by a member of an authorized organization licensed to conduct raffles who is at least eighteen years of age and may also be sold by any person at least eighteen years of age with a blood relationship or affinity with a member of an authorized organization licensed to conduct a raffle pursuant to Section 562022b11. Verified In general it qualifies for the child and dependent care credit but. Something additional to consider is that while you cant take a tax deduction from buying a charity raffle ticket.

How much of the proceeds actually go to St. Jude does not allow any illegal participation in a St. The house is divided into two separate volumes.

St Jude Dream Home Tickets Sold Out Jnews

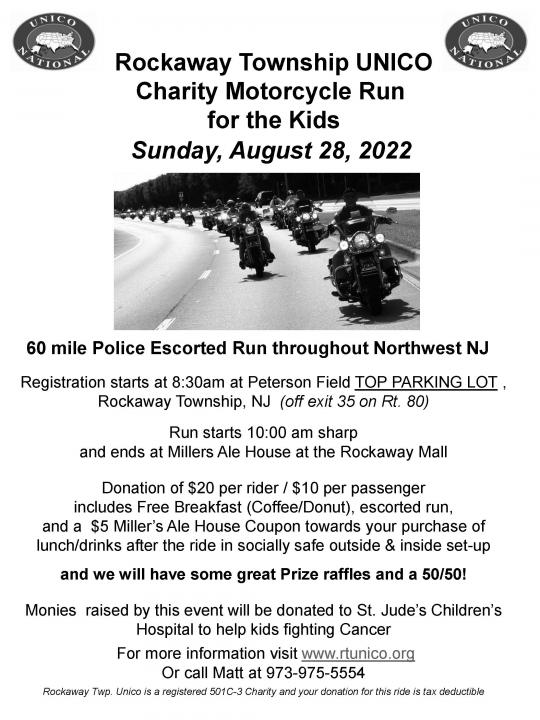

Rockaway Township Unico Charity Motorcycle Run For The Kids Cyclefish Com

St Jude Dream Home Giveaway Faq Everything You Need To Know Fox 8 Cleveland Wjw

Catholic Schools Raffle Catholic United Financial

St Jude Payne Family Homes Team Up For Annual Dream Home Giveaway News Midriversnewsmagazine Com

Why Do Grocery Stores Ask For Donations Tax Breaks

Donation Letter Donation Letter Donation Letter Template Donation Letter Samples

A 550 000 Home Raffle Ends With An Unfortunate Fortune Wfaa Com

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball

Frequently Asked Questions Faq Home For The Holidays

Dream Home Faq St Jude Children S Research Hospital

University Hawks Wrestling Club Home Facebook

A 550 000 Home Raffle Ends With An Unfortunate Fortune Ktvb Com

A 550 000 Home Raffle Ends With An Unfortunate Fortune Ktvb Com